Financial Assets Every Entrepreneur Should Perceive While Investing

Written by: Alisha Chaudhary

The establishment of your enterprise is not an easy task to do. Many aspects need to be looked at when you are entering into the world of entrepreneurship. We understand the confusion and struggle of people who wish to start their venture and that is why we bring articles on those topics that are fully dedicated to a business point of view. This time we are present here to talk about “Financial Assets Every Entrepreneur Should Perceive While Investing”. Besides that, we will also talk about sources of finance for entrepreneurs in India.

By now, you will surely find out the subject of this article. We are sure that many of you will benefit from this article. But for that, you need to follow the entire article without skipping any part. This article is also beneficial for those who are looking to know where they can invest their money or what the best ways to invest their money are. We will also share information on “Financial Investing Terms”. But before starting it, we want to know from our readers what is the most important thing that is usually required to set up a business.

Yes, you are right, finance or we can say investment. Money is really important to start anything and most people look for resources from where they can get investment for their business. Even after setting up a business, investments are still important for growth and expansion as well. So what are the sources of finance for entrepreneurs in India? The list is quite young but quite helpful in terms of finance. Not only in essential financial terms but we also talk about some concepts that are important to know if you are running a small business.

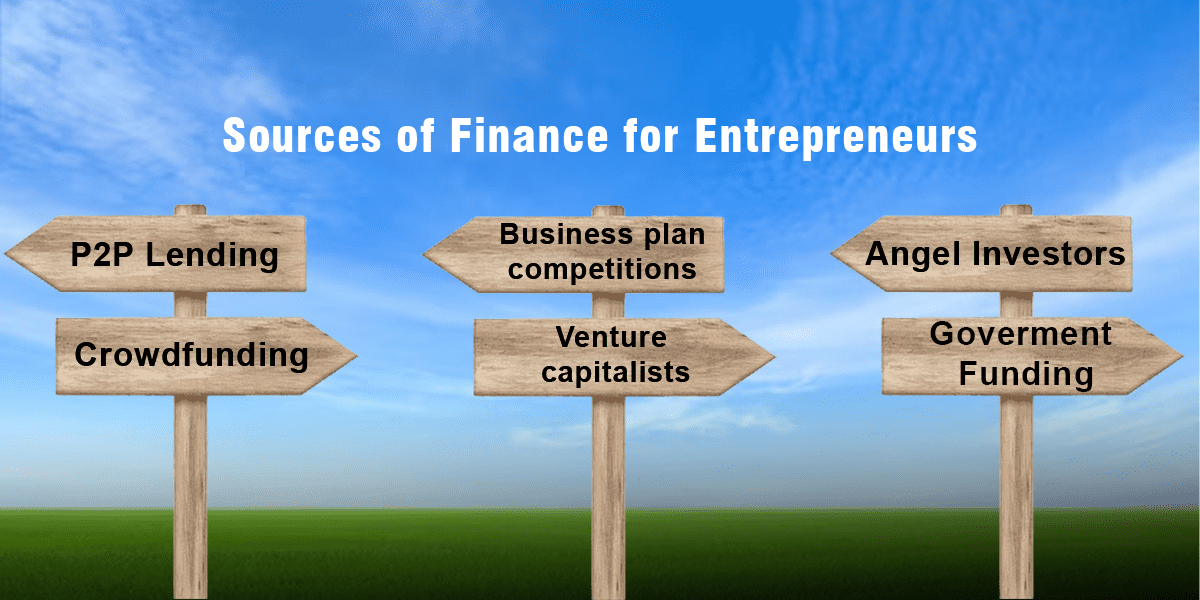

Important Sources Of Finance For Entrepreneurs In India

Investment is the basic need of any business whether it is starting, growing or expanding. The shortage of finance can easily affect the growth of the business. Business works in a main term, the more you put, the more you get. But it is not necessary that you stock enough to run a successful business and hence it is important to know the other sources of finance. Plus, the new-age entrepreneurs and owners of small, medium or big enterprises are looking beyond traditional sources.

Usually, banks provide loans to businessmen for their businesses but this source is quite stressful and time-consuming plus it is quite hectic to deal with traditional banks.

The demand for financing in the Indian business sector is approximately Rs 87.7 trillion and out of this around Rs 69.3 trillion is debt and the rest of the amount of equity demand is around Rs 18.4 trillion. Hence, it is tough for the formal finance sector to fulfill the needs of around 56 million such business ventures across different sectors. Due to that, it becomes important for businessmen to find other methods of sources of finance.

Here we are sharing some sources of finance for entrepreneurs in India:-

P2P Lending

Crowdfunding

Business plan competitions

Venture capitalists

Angel Investors

1 P2P Lending: P2P stands for Peer-to-peer which is also known as “crowd lending” or “social lending”. In simple words, it is a kind of financial technology that permits individuals to borrow or lend money from one another without the interference of a bank. This facility is also available digitally and there are many websites that lend money directly to businessmen. These websites directly connect borrowers to investors. These sites also set the terms and rates. However, it is essential to read all the terms and conditions of these websites before lending or borrowing money.

2 Crowdfunding: The Internet is a great source of everything whether it is about knowledge, getting connected worldwide or being a source of finance. Hence, it is worth saying that the Internet is playing an essential role or source of finance for entrepreneurs in India and crowdfunding is a great example of it. It is the best way to get so many people on a single platform to raise or invest their money on your idea, product or service. Initially, crowdfunding was used to collect donations or in simple words “Chanda” which was used to celebrate the festival but now crowdfunding is also used to provide finance to your business.

3 Business plan competitions (BPCs): If you have watched the business reality show “Shark Tank” then you will easily understand how it works. It is basically an opportunity for nascent businessmen to get investment from other resources. In business plan competitions, entrepreneurs need to present their business ideas to other entrepreneurs to get resources, funds or investments for their business. This opportunity also helps the new start-up to get the chance to get seen and heard by the right people.

4 Venture capitalists: This source of finance came at a later stage of venture growth. Venture Capitalists provide money to companies that are exhibiting high growth potential in return for a stake in the firm. However, it is not easy to attract or take out money from venture capitalists. You need to work on certain things before approaching VCs such as loyal customers, proven sales records and most importantly a strong and sustainable business model.

5 Angel Investors: One of the best sources of finance for entrepreneurs in India in fact all around the world. Angel investing is the best source for young businesses and startups who want to invest. But for that, the borrower needs to impress angel investors with their ideas or products. Angel investors only invest their money in those startups that they believe to have potential growth. These investors are also famously known as informal investors and seed investors.

What Is Financial Investing And Its Terms?

After talking about the sources of finance for entrepreneurs in India, it is time to know about financial investing terms. But before that, it is important to understand the term “Financial Investing”. It is basically a financial product like cryptocurrency or a stock that is purchased with the vision of generating more capital. However, it is worth noting that each investment has particular advantages, disadvantages and risks that will be important to know when is the right time for investors to purchase or sell them. Now, it is time to know about “Financial Investing Terms”.

1 Asset: Many of you are surely familiar with the term Asset. It is basically a resource that has economic value that a person, country or corporation owns with the hope that it will provide benefits in future. It is worth investing your money in those assets that have the potential to have benefits in future.

2 Capital Gain: This term means to get a huge profit by selling an investment that an investor or person purchased at a different price but sold at a high price. Simply put, it is a profit received by selling an investment for more value than you purchased it. In contradiction, it is a capital loss that is generated after you sell something at a low price as compared to your actual purchase.

3 Portfolio: It means bonds, cash, stocks and other assets purchased by a single investor. Whenever experts refer to diversification and asset allocation, they directly or indirectly refer to all your investments in a portfolio in the form of an investment strategy.

4 Dividend: It is basically the portion of the profit of the firm that is given to its investors who own shares of the stock in the company. Several investors give a dividend yield which means a person can expect a portion of the profits from their investment on a monthly, quarterly or yearly basis depending on their investment.

5 Mutual Funds: Investing in mutual funds helps the investor or person to construct a diversified portfolio quickly. However, one should be careful while buying mutual funds and it is advisable to know the terms and conditions of it as it is one of the risky things to do. It is like baskets of bonds, stocks and other investment assets. By permitting investors to purchase into several investments with a single buy, they can construct more diversified portfolios than most individuals could construct on their own.

Target date funds, index funds, and bond funds are the famous types of mutual funds. Many of you are surely keen to know if it is worth investing in mutual funds, as we said earlier, every investment carries some risks, but when it comes to investing in mutual funds, these are typically considered safer investments than buying single stocks. Hope this article helped you to learn about this side of entrepreneurship.